Contents:

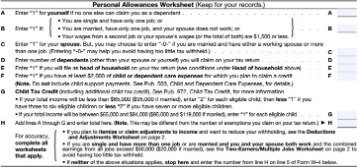

Each partner then pays their share of the taxes on their personal tax return. To give partners the information they need to report their taxes, each one receives a Schedule K-1 showing their share of each type of the partnership’s income, deductions, and tax credits. The partner then includes this income with other sources of income on their personal tax return.

Cummins Named National Player of the Year – Vanderbilt University

Cummins Named National Player of the Year.

Posted: Thu, 13 Apr 2023 07:00:00 GMT [source]

If your contributions are subject to more than one of the AGI limitations, see Worksheet 2. Report unrecaptured section 1250 gain from the sale or exchange of the partnership’s business assets on line 5. Qualified dividends are excluded from investment income, but you may elect to include part or all of these amounts in investment income. See the instructions for Form 4952, line 4g, for important information on making this election. Rental real estate activities with active participation were your only passive activities. Nonrecourse loans used to finance the activity, to acquire property used in the activity, or to acquire your interest in the activity that are not secured by your own property .

Partner’s Instructions for Schedule K-1 (Form – Introductory Material

If you have Schedule E income of $8,000, and a Form 4797, Sales of Business Property, prior year unallowed loss of $3,500 from the passive activities of a particular PTP, you have a $4,500 overall gain ($8,000 − $3,500). On Schedule E , line 28, report the $4,500 net gain as nonpassive income in column . In column , report the remaining Schedule E gain of $3,500 ($8,000 − $4,500).

Use the information reported in box 17 to prepare your Form 6251, Alternative Minimum Tax—Individuals; or Schedule I , Alternative Minimum Tax—Estates and Trusts. The taxpayer is a cooperative and the source credit can or must be allocated to patrons. For more details, see the instructions for Form 1120-C, U.S. Income Tax Return for Cooperative Associations, Schedule J, line 5c. The partnership will give you a description and the amount of your share for each of these items.

Schedule K-1 provides information about the partnership and the partners, including taxable income of partners from passive activities, qualified dividends, net capital gains, and income from other activities. The partners aren’t employees, so they don’t receive Forms W-2 for their shares of income. Instead, the partnership provides each partner with a Schedule K-1, which reports that partner’s share of income, credits, and deductions to be reported on their personal tax return. Some of the amounts reported in this box may be attributable to previously taxed earnings and profits in annual PTEP accounts that you have with respect to a foreign corporation and are therefore excludable from your gross income. Do not include the amount attributable to PTEP in your annual PTEP accounts on Form 1040 or 1040-SR, line 3b.

Small Business Grants and Loans for Felons

If your business is a partnership or LLC, you’ll need this step-by-step guide to IRS Form 1065. Allowances include discounts and complimentary or free products and services. However in the case when the partnership does not meet the four requirements in part 6 of Schedule B, you will still need to file Schedule M-1. But if you’ve recently entered the business world and do not have the nominal information about Form 1065 and the reason for its filing then this article will be your guide.

The partnership will provide your section 743 adjustment, net of cost recovery, by asset grouping. See IRS.gov/forms-pubs/clarifications-for-disregarded-entity-reporting-and-section-743b-reporting for more information. The partnership will report any information you need to figure the interest due under section 453A with respect to certain installment sales. This information will include the following from each Form 6252 where line 5 is greater than $150,000.

Box 22 in Part III of Schedule K-1 will be checked when a statement is attached. Amounts borrowed for use in the activity from a person who has an interest in the activity, other than as a creditor, or who is related, under section 465, to a person having such an interest. Code E. Capital gain property to a 50% organization (30%).

Complete IRS Form 1065 Schedule M-2 (page

This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication.

Unused investment credit from the rehabilitation credit or energy credit allocated from cooperatives . Unused investment credit from the qualifying advanced coal project credit, qualifying gasification project credit, qualifying advanced energy project credit, and advanced manufacturing investment credit allocated from cooperatives . If the amount on this line is a loss, enter only the deductible amount on Schedule SE .

Vanderbilt Bowling Vandy Leaves Vegas as Bowling’s Best – Vanderbilt University

Vanderbilt Bowling Vandy Leaves Vegas as Bowling’s Best.

Posted: Sun, 16 Apr 2023 23:53:12 GMT [source]

Partner’s share of the adjusted basis of noncash and capital gain property contributions, and share of the excess of the FMV over the adjusted basis of noncash and capital gain property contributions. The partnership will show the portion of income or deduction items allocated to you under section 704. These items are included elsewhere in other income or deduction items on Schedule K-1. The amounts reported reflect your distributive share of the partnership’s W-2 wages allocable to the QBI of each qualified trade, business, or aggregation.

Specific Instructions

If the disposition is due to a casualty or theft, a statement providing the information you need to complete Form 4684. You may also need Form 4255 if you disposed of more than one-third of your interest in a partnership. The partnership will separately identify both of the following. You are claiming the investment credit or the biodiesel and renewable diesel fuels credit in Part III with box A or B checked. If you are an individual partner, use this amount to figure net earnings from self-employment under the nonfarm optional method on Schedule SE , Part II.

Let’s go through some of the general inmassachusetts state income taxation that’s needed for each page and the kinds of information you’ll need to provide. You must file Form 1065 on the 15th day of the third month after the date the tax year ended. In the event the due date falls on a Saturday, Sunday, or holiday, you’ll have to file by the next day that isn’t a Saturday, Sunday, or holiday. Full business credit reports & scores from Dun & Bradstreet, Experian and Equifax. Capital gains and losses from like-kind exchanges from Form 8824, Like-Kind Exchanges (and section 1043 conflict-of-interest sales).

When and Where To File Form 1065

To record details about your business’s assets you will need to prepare the balance sheet, hence the Schedule L. It is designed to record the business assets, liabilities, and capital. The IRS is fully informed about the financial condition of your partnership. Some additional information about small business partnerships is required which includes partnership property, foreigners as partners, and tax obligation forms. Schedule B for Form 1065 falls under the header of “other information”. In this section, you have to answer technical questions about your partnership.

The good news is we’ve created this handy guide to answer some of the questions you may have and teach you how to fill out the form properly. For 2021 returns, Form 1065 must be filed by March 15, 2022, unless you file for a 6-month extension, making your new deadline September 15. Remember to file each partner or LLC member’s Schedule K-1 with the Form 1065.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. Here is a list of our partners and here’s how we make money. Completing Form 1065 can be somewhat complicated, so you might want to enlist the assistance of a tax professional to make sure you get it right. You must report information on the value of your inventory at the start of the year if you sell products, as well as the cost of inventory purchased during the year.

Partners Report Income on Schedule K-1

Section 1256 contracts & straddlesForm 6781, line 1Code D. Capital gain property to a 50% organization (30%)See page 13Code F. Amounts paid for medical insuranceSchedule A , line 1; or Schedule 1 , line 17Code N. Reforestation expense deductionSee page 14Codes T through U. Reserved for future useCode V. Section 743 negative adjustmentsSee page 14Code W.

It also includes questions about stock ownership, dealings with foreign financial institutions, and other situations. If you are a partner in a partnership, the information you need to prepare your individual tax return is on the Schedule K-1 you received from the partnership, not on Form 1065. A K-1 can be a complicated forms with lots of lines, but TurboTax asks about the data you need to enter.

Report the total net long-term gain on Schedule D , line 12. A partner’s part of the loss of a partnership as shown on the K-1 statement may affect the partner’s personal taxes. You report your share of the partnership’s net operating loss on Schedule E along with all other types of income, deductions, and tax credits to get your final tax amount due. Form 1065 doesn’t calculate any tax that’s due because partnerships don’t pay their own taxes. Income, credits, and deductions are passed through to their partners to be reported and taxed on their own personal tax returns.

If you have any foreign source qualified dividends, see the Partner’s Instructions for Schedule K-3 for additional information. You have no prior year unallowed losses from these activities. Generally, you may use only the amounts shown next to “Qualified nonrecourse financing” and “Recourse” to figure your amount at risk. Do not include any amounts that are not at risk if such amounts are included in either of these categories. Trading personal property for the account of owners of interests in the activity. An estate is a qualifying estate if the decedent would have satisfied the active participation requirement for the activity for the tax year the decedent died.

- For more information, see the discussion under Passive Activity Limitations, earlier.

- An exception to this rule is made for sales or exchanges of publicly traded partnership interests for which a broker is required to file Form 1099-B, Proceeds From Broker and Barter Exchange Transactions.

- Any income, gain, or loss to the partnership under section 751 .

On a separate line, enter “interest expense” and the name of the partnership in column and the amount in column . If the partnership has investment income or other investment expense, it will report your share of these items in box 20 using codes A and B. Include investment income and expenses from other sources to figure how much of your total investment interest is deductible. You will also need this information to figure your investment interest expense deduction. The partnership will report your share of qualified conservation contributions of property used in agriculture or livestock production. This contribution isn’t included in the amount reported in box 13 using code C.